Ensuring Compliance with Annual Financial Statements

How to Submit Annual Financial Statements to the Estonian Business Register

Follow our comprehensive guide to ensure your company’s annual financial statements are accurately submitted to the Estonian Business Register, maintaining compliance and avoiding penalties.

The Importance of Compliance

Why Submit Annual Financial Statements?

Submitting annual financial statements to the Estonian Business Register is a legal requirement for all companies operating in Estonia. This process ensures transparency, accountability, and adherence to local regulations. Proper submission of these documents helps maintain your company’s good standing and avoids potential legal and financial penalties.

Annual financial statements provide a clear picture of your company’s financial health and operations over the past year. They are essential for stakeholders, including investors, creditors, and regulatory authorities, to make informed decisions. By submitting these statements on time, you demonstrate your commitment to regulatory compliance and corporate governance.

Step-by-Step Guide to Submitting Annual Financial Statements (of your small Estonian company)

Step 1

Prepare the Financial Statements

Ensure your financial statements are complete and accurate, including the Balance Sheet, Income Statement, Cash Flow Statement (if applicable), Notes to the Financial Statements, and Management Report (if required). These documents must comply with Estonian Financial Reporting Standards or IFRS.

Step 2

Access the Business Register

Visit the Estonian Business Register website at ariregister.rik.ee. Log in using your ID card, Mobile-ID, or Smart-ID. If you do not have an Estonian ID, arrange for a representative (such as IBCCS) to submit the report on your behalf.

Step 3

Navigate to the Submission Section

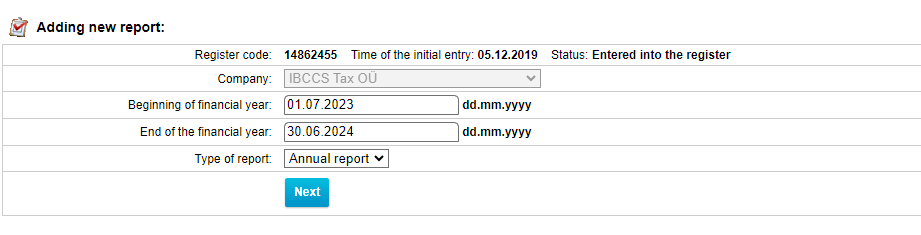

Select the company for which you are submitting the report from the list of companies you manage or are associated with, and click the button “Add new report”.

Step 4

Submit the Data

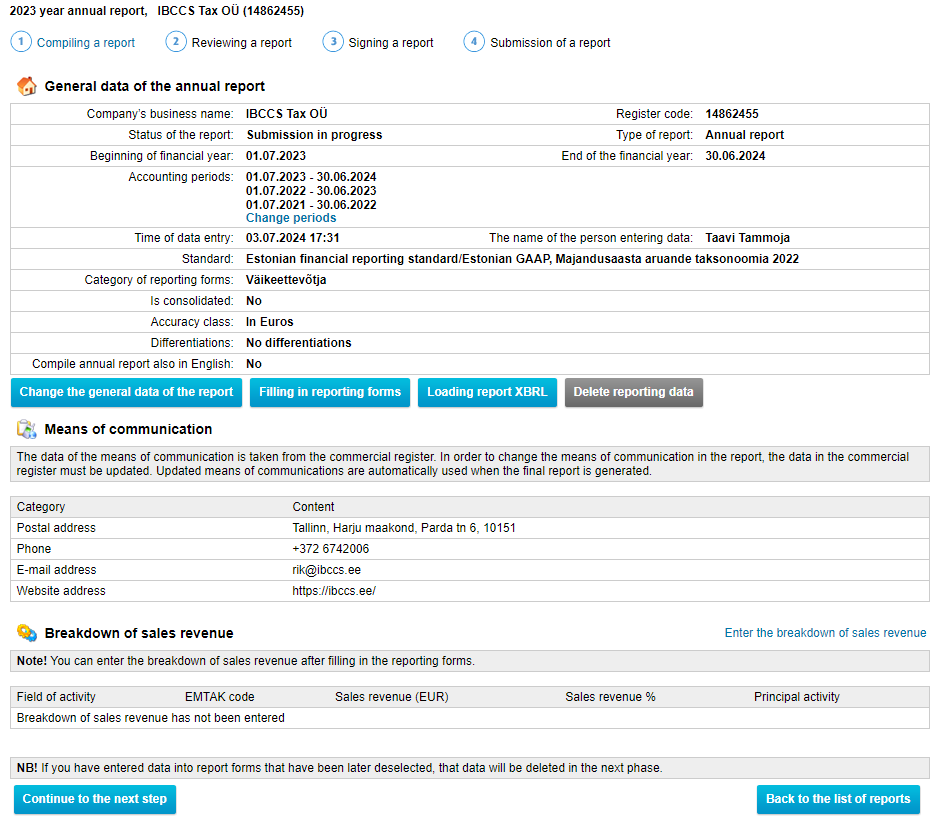

Submit all the relevant data to the Business Register:

Choose your company from the drop-down menu:

Enter the reporting period (beginning and end of the financial year).

If it’s companies first report, the reporting period is normally from the date of incorporation until the end of the reporting period (normally 31.12.20xx)

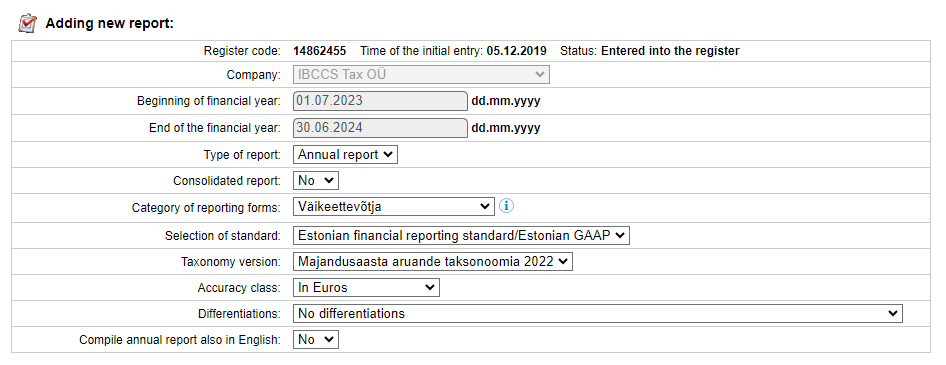

Choose the appropriate options:

- micro undertaking – a private limited company which indicators meet on the balance sheet date of an accounting year all the following conditions: total assets up to 175,000 euros, liabilities not exceeding the owners’ equity, one shareholder who is also the member of the management board and which sales revenue during an accounting year is up to 50,000 euros;

- small undertaking – a company registered in Estonia which is not a micro undertaking and only one of which indicators may exceed on the balance sheet date of an accounting year the following conditions: total assets 4,000,000 euros, sales revenue 8,000,000 euros and average number of employees during an accounting year 50 persons;

If you qualify as micro-undertaking report, select “Mikroettevõtja” as the category of reporting forms. In such case, you may submit an abbreviated (simplified) report, without needing to submit the management report. For most other small businesses, they must select “Väikeettevõtja” – small undertaking.

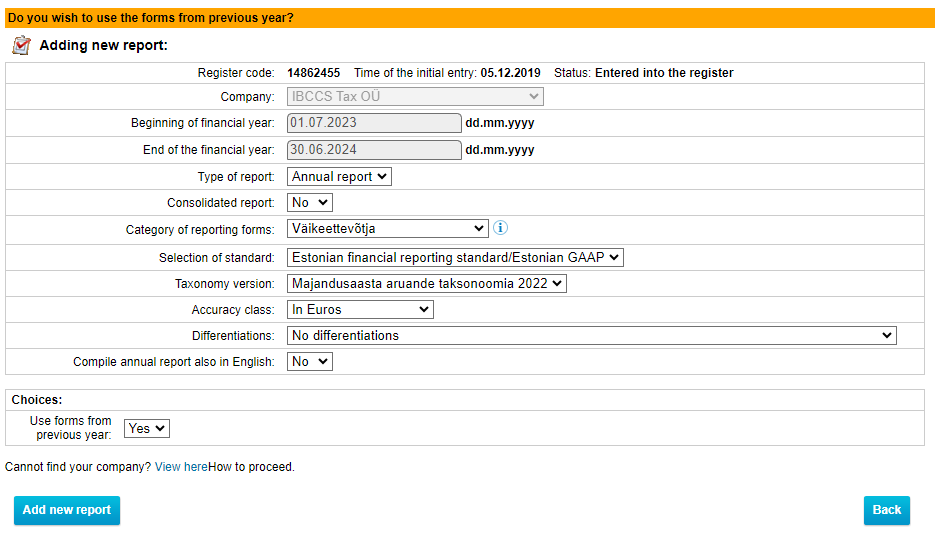

In the next screen, you may want to select “Use forms from the previous year: Yes, and click “Add new report.”

What kind of report you need to choose

Find more info: Annual report – Official Regulations

Abridged annual report of a small business

The abbreviated financial year report of a small company is prepared based on the Estonian financial reporting standard and consists of two main reports: the balance sheet and the profit and loss statement and appendices. A small entrepreneur must also prepare a management report.

The abbreviated annual report of a micro-entrepreneur

The abbreviated annual report of a micro-entrepreneur consists of two main reports: a short balance sheet and a profit and loss statement and an appendix. The number of microenterprise supplements is significantly limited, and the following must be disclosed:

- the total amount of off-balance sheet contingent and binding liabilities;

- obligations for the fulfillment of which the entrepreneur has given a guarantee, and a description of these guarantees;

- advances paid to a member of the executive management and senior management body and the amount of loans granted, including the amount of loan repayment or write-off or loan waiver, as well as payment deadlines and interest rates and other important conditions.

If the accounting entity has acquired or pledged its shares during the financial year, the acquired or pledged transferred and non-transferred shares are presented in the appendices:

- the number of shares and their nominal value, if there is no nominal value, the calculated nominal value and share in the share capital;

the amount of the fee paid for the shares and the reason for their acquisition or taking them as collateral. - A micro-entrepreneur who takes advantage of the opportunity to prepare a shortened financial year report does not need to prepare a management report.

Management Report

Management reports provide an overview of a company’s activity and circumstances that are of material importance to evaluating the company’s financial condition and economic activity, key events in the financial year, and forecast development trends in the next financial year. One should certainly not forget to put down the main activity and ancillary activities of the accounting entity.

In the case that the owners’ equity is not in accordance with the requirements of the Commercial Code (meaning that it is negative) as at the end of a financial year, the management report must include a description of activities that have been performed or will be performed to be sustainable in the future or state if a different decision has been adopted.

Choose the type of report and whether you want the report also to be compiled in English.

The official report needs to be in Estonian, but almost anyone can prepare it with a little help from Google Translate.

Fill in the required fields:

Minimum Data to be added (Example)

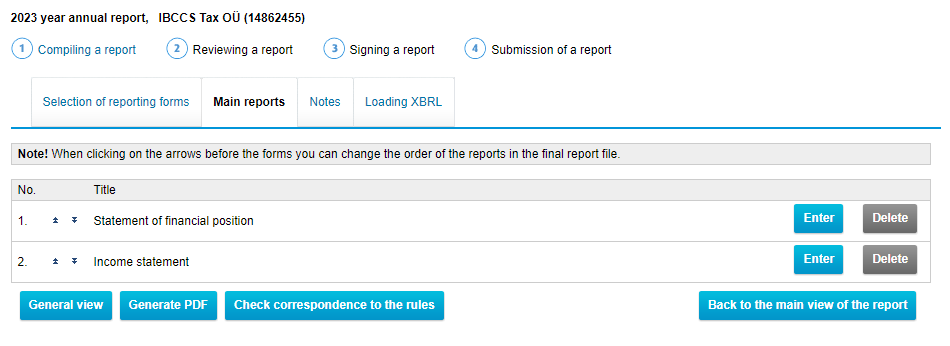

MAIN REPORTS

- Balance Sheet:

- Cash 2500 EUR

- Share capital: 2500 EUR

- Income Statement:

- Revenue 0 EUR (if your company earned any revenue a breakdown of revenue types needs to be entered as well, on the main page)

- Profit 0 EUR

NOTES:

- Note 1 Accounting policies

- General information: OÜ IBC (edaspidi: ettevõte) 2024. aasta raamatupidamise aastaaruanne on koostatud kooskõlas Eesti hea raamatupidamistavaga. Hea raamatupidamistava põhinõuded on kehtestatud Eesti Vabariigi raamatupidamise seaduses, mida täiendavad Raamatupidamise Toimkonna poolt välja antud juhendid. Raamatupidamise aastaaruanne on koostatud eurodes.

- Note 2 Labor expense

- total labour expense 0 EUR

- Average number of employees in full time equivalent units: 0

- Note 3 Related parties

- Remuneration and other significant benefits calculated for members of management and highest supervisory body

- Remuneration: 0 EUR

- Remuneration and other significant benefits calculated for members of management and highest supervisory body

Wrapping up:

Once everything is filled you hit “Check correspondence to the rules”, and “Generate PDF”.

Then on the next page you sign it off.

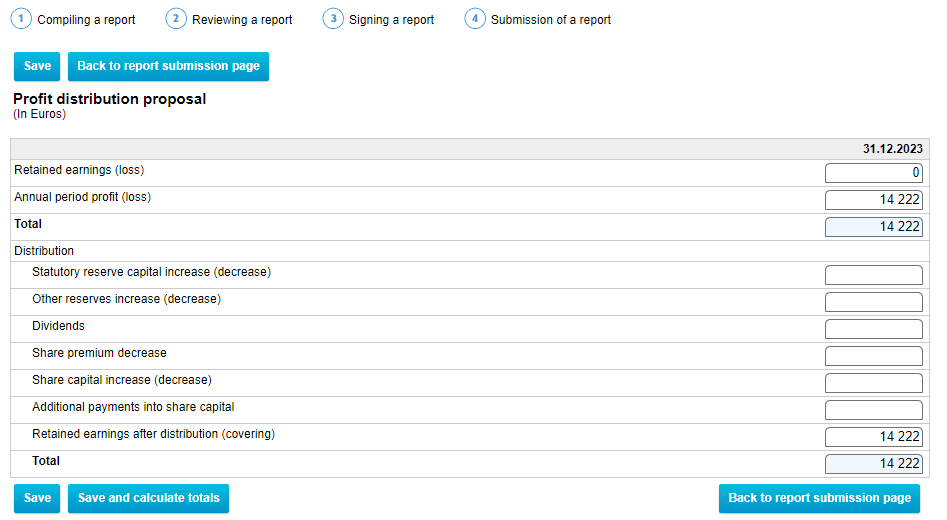

Profit distribution proposal:

Retained earnings (loss) – results from previous periods before this financial year

Annual period profit (loss) – results of this period

Under the Distribution sector – this is where you must decide how the profits or losses will be distributed.

Assuming your business generated profits and you want to retain the profits you can decide to retain all in the “Retained earnings after distributions (covering) field.

After entering all the data, click “Save and calculate totals”

Final Step:

Submit the report to the register confirming the Ultimate Beneficiary Owners.